Coerced debt is debt that an abusive partner has taken out in your name either:

- Without your knowledge, or

- Because your abusive partner used threats or force to make you to take out the debt.

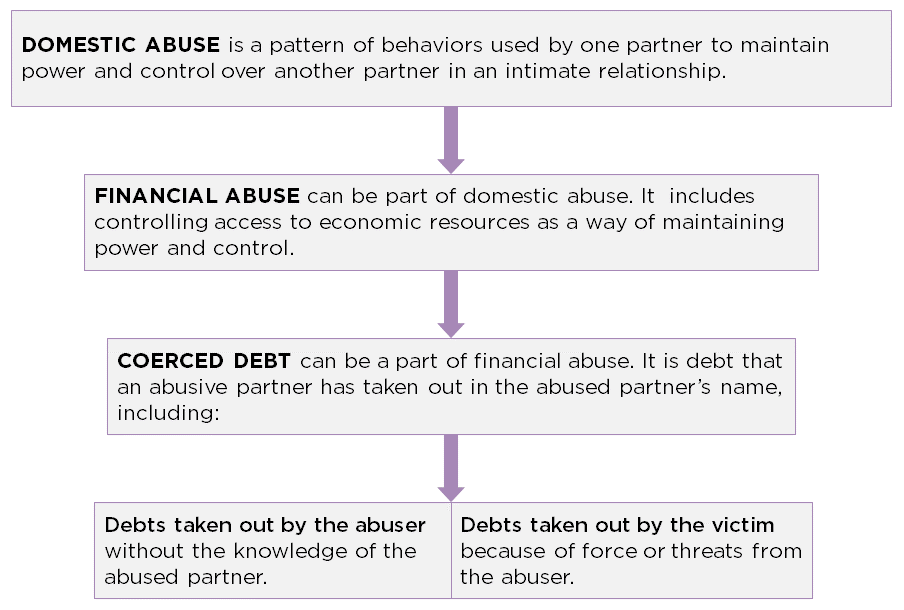

Coerced debt exists where there is domestic abuse. Domestic abuse can be physical, emotional, or financial. Coerced debt is one type of financial abuse. Abusers use coerced debt to control their victims.

Coerced debt is very common, but it is not talked about a lot. If you have coerced debt, you are not alone. There are ways you can challenge coerced debts so that they don't hurt your credit.

Coerced debt can be:

- A fraudulent account, such as a credit card or a loan, that is opened by an abuser or opened because of force or threats from an abuser. Some examples of this would be if an abuser took out a new loan by forging his partner's signature or if an abuser forced a partner to take out a loan under threat or fear of harm.

- A fraudulent charge that was added to an existing credit account by an abuser or because of force or threats from an abuser. In this case, the account might have been legitimately opened by the victim of coerced debt. A specific charge or purchase may be considered coerced debt. An example of this would be if an abuser made purchases using a partner's credit card.

How Domestic abuse, financial abuse, and coerced debt are related

Coerced debt is a form of identity theft. As long as you didn't benefit from the debts by using the money or items purchased, you may be able to challenge the coerced debt.

If my abuser forced me to take out a car loan and then I used the car, am I considered a victim of coerced debt?

If you benefitted from the debt by using the car willingly, it will be challenging for you to claim identity theft protections. Talk to an attorney if you have a similar situation (see the List of Domestic Abuse and Legal Resources for a list of free and low-cost attorneys).

While physical safety is essential, your economic safety is important, too. Economic factors are often a reason why it is difficult to leave an abusive relationship.

For more on the topic of coerced debt, read Texas Appleseed?s report Abuse by Credit: The Problem of Coerced Debt in Texas.