You have a legal right to get your credit report for free once every 12 months from each of the three nationwide consumer reporting agencies (Equifax, TransUnion, and Experian). If you have already requested your credit reports within the past 12 months, you will have to pay a small fee (no more than $12.50 per report) to get the reports again.

For your safety, it is important to know that when you share your address with the consumer reporting agency to get a credit report, it will become part of your file and may appear on your credit report. Consider whether or not to disclose a safe address, because an abuser may try to access your credit report and see what addresses are included. You may want to consider using a P.O. Box address or the address of a trusted relative or friend. Keep in mind that since this address will become permanently part of your credit file, future creditors or potential creditors may attempt to contact you at whatever address you use.

If you are worried that someone else is accessing your current address through your consumer report, please ask for help from the National Domestic Violence Hotline or a local domestic violence advocate.

The three nationwide consumer reporting agencies are Experian, Equifax, and TransUnion. They are companies that collect information about your credit history that businesses, including lenders, employers, or landlords, can use. For example, lenders decide if they want to lend you money by looking at the information collected by consumer reporting agencies. Lenders also use this information to decide what interest rate to charge you.

You should ask for a copy of your credit report from EACH of the three nationwide consumer reporting agencies. It is important to review all three reports because Equifax might list information that Experian does not, or vice versa. Or, the information about a debt on TransUnion might be incorrect, while Experian’s information may be correct. You want to know what information all three reports contain.

To access your credit reports online:

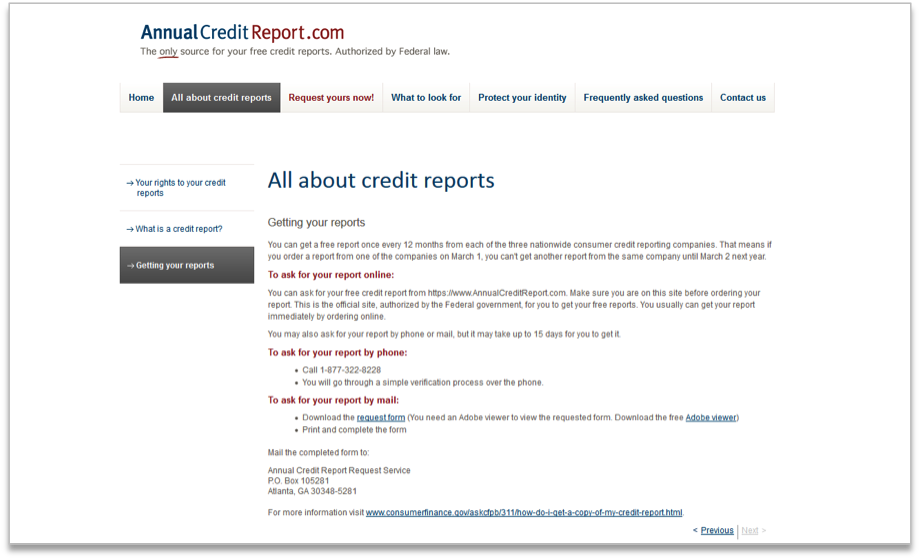

- Go to www.Annualcreditreport.com. Make sure you type in the correct web address. This is the only site that federal law says must give you your credit reports for free once a year. Other sites with similar names will make you pay for access to your reports. Other sites (like Credit Karma) will send you unnecessary credit card offers when you check your credit with them. Just use www.Annualcreditreport.com.

- This is what the website for www.Annualcreditreport.com looks like:

- You will need to correctly answer some security questions. These questions might ask you to recall information such as the name of a lender, the date an account was opened, the monthly payment amount on an account, or a previous address used to receive mail. The security questions are different every time you request your credit reports. “None of the above” can be the right answer choice. There also might be a question that does not make sense because it references people or places you don’t know. “No” or “I don’t know” can be the right answer choice.

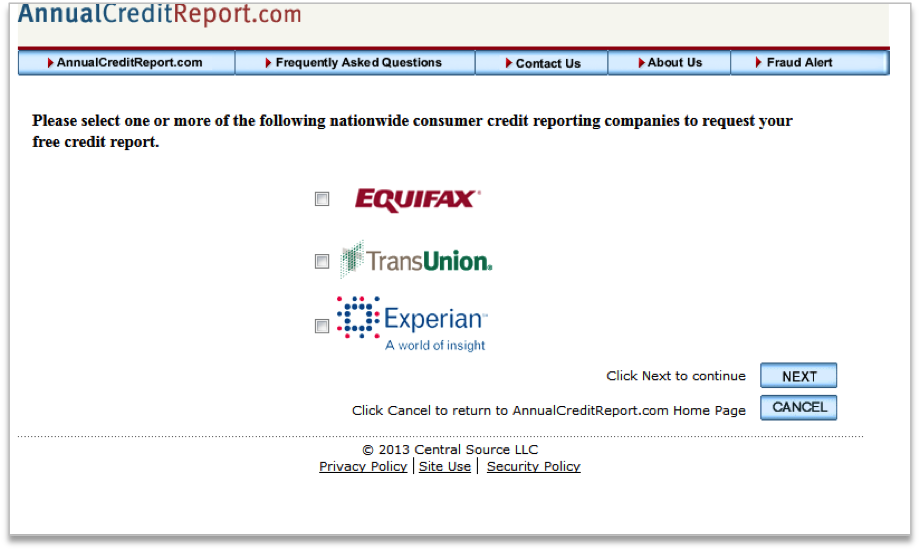

- Make sure you click the box that says that you want to request a report from Experian, Equifax, and TransUnion. You will get a separate report from each of these consumer reporting agencies.

TIP: You will have to request each report one by one. Do not exit out of AnnualCreditReport.com until you have successfully gotten all three reports. The website where you’ll request all three reports is shown below.

- Your credit report will open in your internet browser. You can print out the screen. With TransUnion and Equifax, you can also get a PDF copy that you can download and save to your computer. Try to have a copy saved to your personal computer or printed out for your records. If you are using a public computer, make sure your credit reports are not saved to the computer.

What if I’m not able to use the Internet to request my credit reports? And what if I don’t know the answers to the security questions?

You might not be able to answer the security questions. That’s okay. If you can’t answer the security questions online, or if you don’t have access to the internet, you can download the request form and mail it in.

Your credit report will then be mailed to you within two weeks. You may have to request several times if the identity documents you send to the consumer reporting agencies are not sufficient. You can also call 1-877-322-8228 to get your credit report.