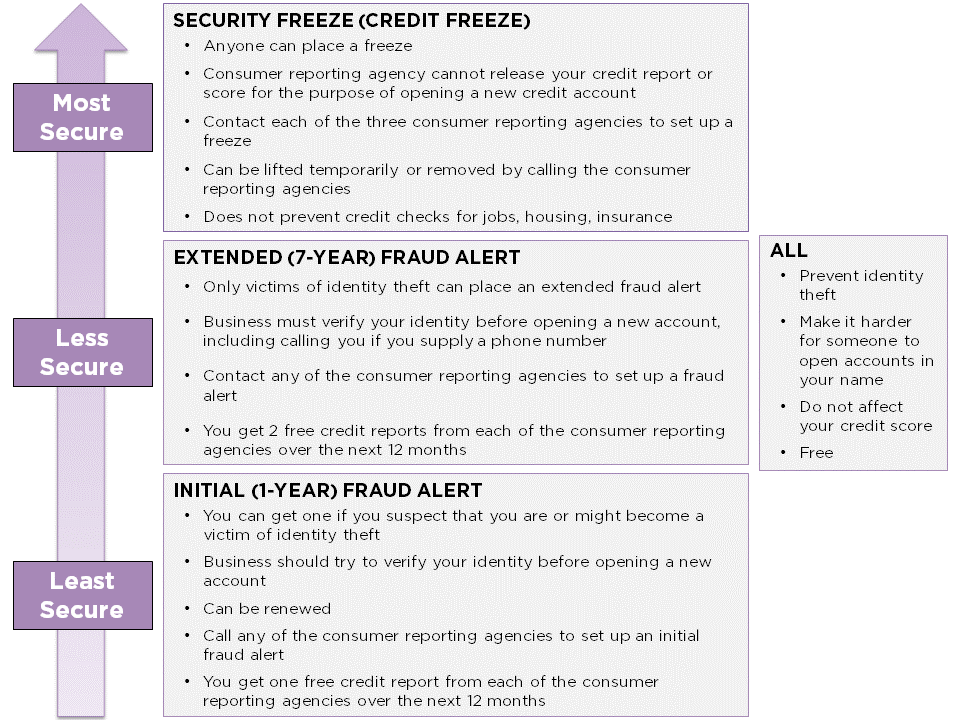

A security freeze, commonly known as a credit freeze, and fraud alert are both ways to prevent identity theft. There is no charge for these protections. Putting a credit freeze or fraud alert in place with the three major credit reporting agencies—Equifax, Experian, and TransUnion—makes it harder for someone to open new accounts in your name.

Ways You Can Protect Your Credit

For your safety, it is important to know that when you share your address with the consumer reporting agency to establish a security freeze or fraud alert, it will become part of your file and may appear on your credit report. Consider whether or not to disclose a safe address, because an abuser may try to access your credit report and see what addresses are included. You may want to consider using a P.O. Box address or the address of a trusted relative or friend. Keep in mind that since this address will become permanently part of your credit file, future creditors or potential creditors may attempt to contact you at whatever address you use.

Consumer Reporting Agency Contact Information

Experian

888-EXPERIAN (888-397-3742)

Experian Security Freeze

P.O. Box 9554

Allen, TX 75013TransUnion

888-909-8872

TransUnion

P.O. Box 160

Woodlyn, PA 19094Equifax

888-298-0045

Equifax Information Services LLC

P.O. Box 105788

Atlanta, GA 30348-5788

Most Secure: Credit Freezes

A credit freeze, or security freeze, completely locks down your credit. It restricts access to your credit reports. This means that no new accounts can be opened in your name while the credit freeze is in place, unless you give explicit permission.

Tip: A credit freeze does not prevent credit checks for the purposes of employment, housing, and insurance-related reasons.

There are three ways you can get a credit freeze. You can:

- Call each of the three nationwide consumer reporting agencies. They will ask for some personal information like your name, address, social security number, and date of birth in order to put the freeze in place.

- Write each of the three nationwide consumer reporting agencies a letter requesting the credit freeze. Send the letter certified mail, return receipt requested. Keep a copy of the letter for your records.

- Fill out the online form that each nationwide consumer reporting agency has on its website. Save a copy of the form for your records.

We recommend that you write or fill out the form online so that you have proof that you requested the freeze. The column on the right has the contact information for the three nationwide consumer reporting agencies.

You can temporarily lift the freeze or remove it altogether by calling the consumer reporting agencies. If you call, the agency has to lift the freeze within one hour. You can also temporarily lift the freeze for a specific creditor if you are applying for credit. A credit freeze does not prevent credit checks for jobs, housing or insurance.

After you get the credit freeze, you will get a PIN or password from each agency. Write it down and keep it in a safe place. You must have it in order to lift your credit freeze in the future. If you lose your PIN, you can request a new one. You will need to contact each consumer reporting agency directly, and you will need to provide proof of your identity in order to get a new PIN.

A credit freeze is a stronger protection than fraud alerts. It prevents an abuser from opening new credit accounts in your name. You can still apply for credit by temporarily lifting the freeze. For these reasons, we strongly recommend that you put a credit freeze in place for yourself and your children, if you have any.

How can I protect my children from financial abuse?

Abusers sometimes harm the credit of their partners’ children. For example, a parent can take out credit cards using the social security number of a child. If you have children and are worried about their economic safety, here are some steps you can take:

- Place a credit freeze for your children, and

- Keep their social security number and other personal identifying information secure.

In order to place a credit freeze for a child, a parent needs to provide written proof (such as a birth certificate) that the parent has authority to act on behalf of the child. A parent is able to place a credit freeze for a child without the other parent’s involvement. Go to the websites of the consumer reporting agencies to find the “Minor Freeze Request Form” that a parent needs to freeze a child’s credit.

Less Secure: Extended Fraud Alerts

When you have an extended fraud alert on your report, a business must take reasonable steps to verify your identity before a new account is opened in your name. For example, if you have an extended fraud alert and someone tries to open a new credit card in your name, the credit card company would first have to try to contact you to confirm that you in fact do want to open a new line of credit. When you request the extended fraud alert, you need to make sure to give the consumer reporting agency the contact information that should be used.

An extended fraud alert lasts for seven years. You need to be a victim of identity theft in order to place an extended fraud alert.

There are three ways you can get an extended fraud alert. You can:

- Call each of the three nationwide consumer reporting agencies.

- Write each of them a letter requesting the extended fraud alert. Send the letter certified mail, return receipt requested. Keep a copy of the letter for your records.

- Fill out the online form that each nationwide consumer reporting agency has on its website. Save a copy of the form for your records.

Once you tell one consumer reporting agency that you want the extended fraud alert, that agency must inform the other two agencies. However, we advise that you contact all three individually so that you make sure the alert is put in place. In addition to contacting each agency directly, we recommend that you write or fill out the form so that you have proof that you requested the extended fraud alert.

You will need to provide your identity theft report—either a police report or the Identity Theft Affidavit—to get the extended fraud alert. Guide 4 has details on how to get that report.

You will get a letter from each consumer reporting agency confirming that the extended fraud alert has been put in place. Keep this letter for your records.

When you place an extended fraud alert, you will be able to request two free copies of your credit reports from each consumer reporting agency over the next 12 months. This is in addition to the one free copy that everyone gets once every 12 months.

One major downside of an extended fraud alert is that if a person knows your personal identifying information, that person might still be able to take out debt in your name. So even if you have the extended fraud alert in place, if your abuser knows personal identifying details about you, that person could still rack up debt in your name.

Least Secure: Initial Fraud Alerts

You can place an initial fraud alert if you suspect you are, or might become, a victim of identity theft. The initial fraud alert lasts for one year. You can renew the initial fraud alert at the end of the year.

There are three ways you can get an initial fraud alert. You can:

- Call each of the three nationwide consumer reporting agencies.

- Write each of them a letter requesting the initial fraud alert. Send the letter certified mail, return receipt requested. Keep a copy of the letter for your records.

- Fill out the online form that each nationwide consumer reporting agency has on its website. Save a copy of the form for your records.

Once you tell one consumer reporting agency that you want the initial fraud alert, that agency must inform the other two agencies. However, we advise that you contact all three individually so that you make sure the alert is put in place. In addition to contacting each agency directly, we recommend that you write or fill out the form so that you have proof that you requested the initial fraud alert.

When you place an initial fraud alert, you get one free copy of your credit report from each consumer reporting agency. This is in addition to the one free copy that everyone gets once every 12 months.